This week, I’m going to follow the money. And no, I’m not investigating a corruption scheme or a political scandal—after all, we talk about social media on this blog. And social media is where the money seems to be going.

In a recent Time Magazine article, Hootsuite CEO Ryan Holmes chose social payments as one of the top social media trends to watch for in 2015. We also brought up social payments in several episodes of our news summary video series, Social Update. This week, the ephemeral video messaging app Snapchat, notorious among millennials, announced the launch of their money transfer system, Snapcash. Users can send money to their friends by simply typing the amount, preceded by a dollar sign, into the chat box and pressing the “Send” button.

Powered by Square, the payment processing startup founded by Twitter co-founder Jack Dorsey, Snapcash connects to the users’ debit card account. The Square back-end allows for instant deposits and withdrawals—skipping a step required for storing cash in a peer-to-peer mobile payment app Venmo, for example. This answers the biggest question for analysts about whether Snapcash will take off: how much friction will new users face? While some say the video messaging app is bound to succeed, catering to the demographic that expects the instant gratification and trusts the app with their most private images, others say that even a single malfunction or privacy breach will be enough to break that trust.

However, one thing is certain: social payments are on the rise. With the concurrent spike in popularity of mobile messaging apps, portion of total online time spent on social networks, and referral power of social media, my guess is that it’s only a matter of time until we see a social payment option on each of the major networks.

TL;DR – Social Payments

Two kinds of social payments

Brands are aware that a significant amount of purchases have been made as a result of social advertising. For example, one study found that almost 8 percent of traffic to online retailers comes from social networks, which is a 1 percent increase from last year’s findings. With similar results reported by several marketing research agencies, it’s only natural that major social networks are looking to cut out the middle man, and introduce payment methods directly on the channel’s sponsored messaging.

Two major questions that remain are whether the social payment trend will actually take off, and if it does, what form it will take. Currently, social payment branches out into two major categories: peer-to-peer transfers and online purchases. Snapcash is testing the waters in the former category, while Twitter made a foray into e-commerce earlier this fall.

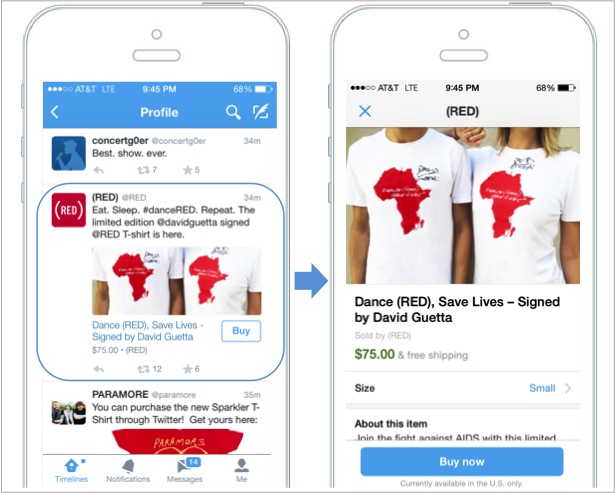

Twitter’s first step towards its role as an e-commerce tool was the launch of a test run for its Buy button. This feature adds a button to sponsored Tweets and Twitter Cards from the network’s partners, which enables users to purchase advertised products or services directly in the network. Twitter has launched the first round of testing to a small portion of its US users in September, so we might hear results of the experiment soon.

Now, let’s let our imaginations run wild for a bit: if Facebook had a money transfer system, what form would it take? With both ads and messaging features, the network has the potential to go either way when it comes to social payments. When Facebook standalone Messenger app was released, there was talk about Facebook’s plans for a money transferring feature in the app. These rumours were based on the discovery of money transferring capabilities built into Facebook Messenger’s source code. Considering Snapchat’s recent reveal, the truth behind these plans isn’t difficult to imagine, although the rumours are yet to be confirmed. And, as we’ve seen from KLM Royal Dutch Airlines’ campaign launched earlier this year, direct purchases using Facebook are also very much within the realm of possibility.

The future of social payments

In a way, we have been preparing for the social payment takeover for a long time: from mobile banking apps to scannable Starbucks card codes, payment has been shifting to smartphone screen. The test runs for both Apple Pay and Google Wallet are getting smartphone users more comfortable with the idea of using their phone to pay while also simplifying the process to skip opening apps or retrieving banking information.

While social networks are just dipping their toes into social payments, successful payment apps include a social element to their transfers. I’m talking about Venmo, a mobile monetary transfer service that allows users to send instant payments to their contacts. To use the app, you need to make an account using your email address, or log in with Facebook. Writer Felix Gillette explains Venmo’s social functions best: “Part of the Venmo experience is the continuous scroll of your friends’ microeconomic activity as told through droll synopsis, inside jokes, and emoji. Such is the avant-garde of home economics circa 2014,” Gillette writes in his Businessweek article.

Gillette isn’t the only one who sees significance in Venmo’s descriptive transfers. In a Medium piece called Public Displays of Transaction, Chiara Atik ponders on the fact that, in many ways, money transfer apps are the most genuine kind of social network. “Would You Rather: A date see you naked, or a date see your 2013 tax return?” Atik muses. Perhaps this is the greatest cultural significance of social payments—a willing end to Internet anonymity, where we move into an age when social enables us to both exchange money and show off our latest purchases for anyone to see.

Do you think the social payment trend will take off? Share your thoughts in the comments below!